Successful Surcharging

WHAT IS SURCHARGING?

Surcharging is the practice of adding a small fee to a credit card transaction to cover the merchant’s costs for processing the payment. Instead of the merchant having to absorb this expense, the customer who chooses to pay by credit card pays for the processing costs that do not apply to other payment methods. As credit card fees continue to rise, merchants face higher fees that negatively affect their margins. Surcharging is a great solution to offset these costs.

Surcharging Rules

- As of early 2024, only two states and one US territory still prohibit credit card surcharging. In the following jurisdictions, you won’t be able to impose surcharges (at least for now):

- Connecticut

- Massachusetts

- Puerto Rico

- You must notify the card association and your merchant services provider of your intent in writing at least 30 days in advance. (Note: American Express surcharge rules do not require you to provide notice so long as you comply with all other rules.)

- Surcharge amounts are limited to your effective rate for credit card transactions, capped at 3% (2% in Colorado). In other words, you can’t profit from surcharges; you can only recoup your baseline costs.

- DEBIT CARDS ARE NOT SURCHARGEABLE

- You must post appropriate notice inside your store at the entrance and the point of sale.

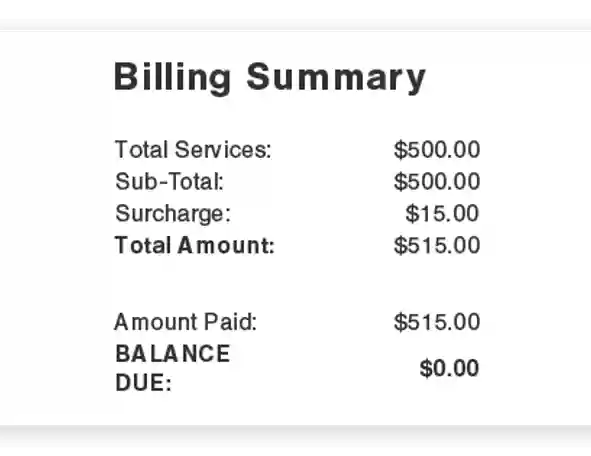

- You must include the surcharge amount on the receipt as a separate line item. The surcharge must also be included in the network authorization request and settlement.

Why Implement Surcharging

- Surcharging is a great alternative to raising prices

- Surcharging only applies to clients paying with expensive credit cards that negatively impact margins. Clients paying with other forms of payment do not incur these fees

- Surcharging provides clients with a choice. They can use Cash, Check or Debit cards and not be charged a fee, or they can pay with a credit card that gives them points, miles, cash back and other monetary benefits and be assessed a nominal fee

- Surcharging allows hospitals to keep more of what they work so hard to earn. In a time when supplies and other operating costs are going through the roof, hospitals must find ways to keep their margins intact so they can use those funds to invest in continuing to improve their hospitals and reward their employees.

Steps for Successful Implementation

If done correctly, it has been proven that Surcharging will have little to no effect on customer loyalty or attrition levels

Notify Clients

Any type of customer pricing notice, whether via emails to existing clients informing them of the upcoming change or simply telling people at checkout will make for a more seamless transition

Be Sympathetic to Any Clients Who Are Irritated

Though Surcharge is very mainstream today and your clients have DEFINITELY PAID a surcharge fee at other businesses, some clients will express discontent to the new policy. Be sympathetic to any client concerns, but explain that with rising operating costs, rather than raise prices, the hospital has decided to implement this policy to allow clients a choice and not just do a blanket increase across the board.

Be Transparent

In the case of surcharging, it is a legal requirement that signage is installed in-store to notify customers. These signs come from credit card companies and must be displayed at the entry and terminal. Put up signage so that customers aren’t surprised at the register.

Provide Options

Let clients know that if they pay with Cash, Check, or Debit Card, there is no Surcharge. Explain that credit cards that provide points, miles, cashback etc. cost you as a business significantly more money to process than debit cards. So, rather than raise prices which would affect ALL clients, you are providing your valued clients with a choice. If they pay with Debit Card, Cash or Check, there is no fee. However, if they want the miles, the points, the cash back, then they will need to pay that fee.